What Lenders Really Look For (Hint: It’s Not Just Your Credit Score)

Introduction: The Myth of the Magic Number

If you’re thinking about buying a home, you’ve probably felt overwhelmed by the constant, often conflicting advice about credit scores. It can feel like your entire future rests on a single, mysterious number that you must achieve to get a mortgage. This intense focus on one score creates a lot of anxiety, making the dream of homeownership feel more like a pass/fail test you can’t afford to fail.

The truth is, while your credit score is important, it’s only one chapter in your much larger financial story. Lenders and their underwriting teams are trained to look at a complete picture of your financial health, not just a three-digit number. This article will cut through the noise and reveal the surprising factors that truly drive lending decisions, based on how the industry actually works today.

1. Your Score is a Starting Point, Not a Final Decision

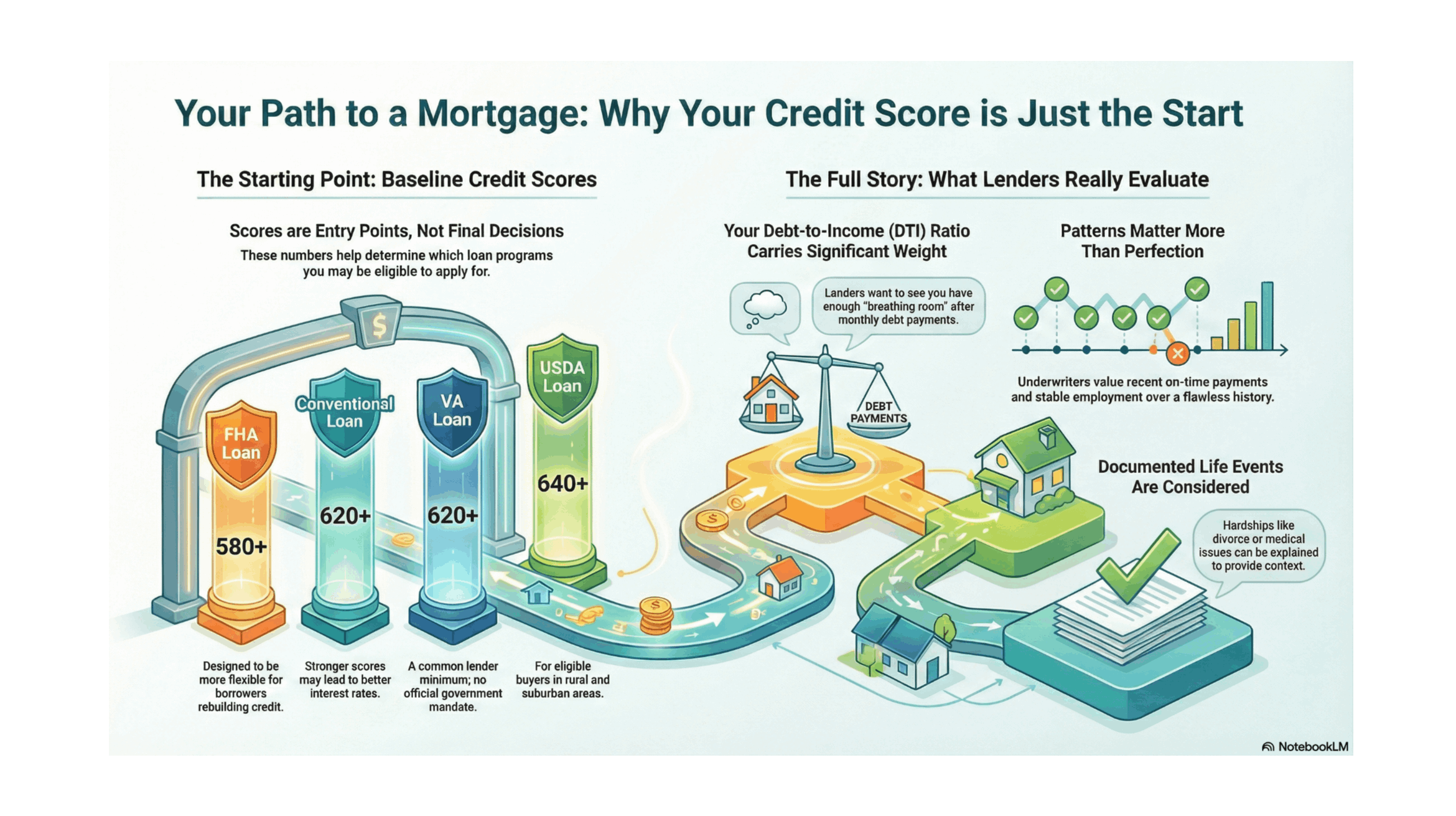

The primary function of a credit score in the mortgage process is to open the door to a conversation. It helps a lender determine which loan programs—like FHA, Conventional, VA, or USDA—might be available to you. For example, FHA loans are often designed with more flexibility for those rebuilding credit, while Conventional loans may have a higher baseline requirement. Your score gets you in the room, but it doesn't decide the outcome of the meeting.

Meeting a minimum score is not an automatic approval; it’s simply the first checkpoint in a comprehensive review of your finances. This should be reassuring. The goal isn't to achieve an impossible standard of perfection, but to present a complete and honest picture of your financial responsibility.

"These baseline scores represent starting points in the conversation, not finish lines. Your complete financial profile—income stability, debt management, savings, and documented compensating factors—determines your actual approval and terms."

2. Your Debt-to-Income Ratio Can Matter More Than Your Score

Your debt-to-income (DTI) ratio is the percentage of your gross monthly income that goes toward paying your monthly debt obligations—including things like car loans, student loans, credit card payments, and your proposed new mortgage payment. In the eyes of an underwriter, this ratio can often carry more weight than your FICO score.

Why? Because a low DTI demonstrates that you have financial "breathing room." It shows that you can comfortably handle your new mortgage payment alongside your existing debts, with enough cash left over for living expenses and unexpected costs. A high DTI, on the other hand, suggests you might be stretched too thin, increasing the risk of default.

This can lead to some counter-intuitive outcomes. For example, you could have a 720 FICO score and a 50% DTI and be seen as a higher risk than someone with a 660 score and a 30% DTI. The second person, despite the lower score, has a greater capacity to handle payments without financial strain. This powerful ratio is one of several "compensating factors" that can strengthen your application, even if your score isn't perfect.

3. Lenders Acknowledge That Life Happens

One of the most reassuring aspects of modern mortgage underwriting is that lenders can and do consider documented life circumstances when evaluating credit challenges. Underwriters recognize that legitimate credit setbacks can arise from life-altering events like a divorce, a serious medical hardship, a natural disaster, or widespread economic disruptions.

The key word here is "documented." If your credit was damaged by an event beyond your control, be prepared to provide a clear, written explanation along with supporting evidence. This documentation isn't about judging your past; it's about providing the underwriter with a clear, factual context for the numbers on your credit report, allowing them to see the full story.

What matters most to an underwriter is the trajectory since the hardship. They are trained to look for patterns of responsibility over time, not an impossible standard of perfection. Demonstrating this recovery, along with other compensating factors like cash reserves, shows an underwriter you are a reliable borrower today, capable of overcoming circumstances that were beyond your control.

4. A 'No' From One Lender Isn't the End of the Road

If you are denied a mortgage by one lender, it doesn’t automatically mean you’ll be denied by everyone. This is due to an industry practice known as "lender overlays." An overlay is an additional, stricter requirement that a specific lender adds on top of the baseline minimums set by government agencies like the FHA or VA.

Lenders create these overlays based on their own internal risk tolerance and market conditions. This is an empowering piece of information because it gives you resilience. A denial may simply reflect one institution’s specific policies, not your overall creditworthiness. Understanding this transforms a "no" from a final judgment into a data point on your journey to find the right lending partner.

This is where strong compensating factors become your greatest asset. These are positive elements in your financial profile that help offset a lower credit score or other weaknesses. Key examples include:

- Significant down payments

- Stable long-term employment in the same field

- Minimal monthly debt obligations (a low DTI)

- Cash reserves to cover several months of mortgage payments

An application that one lender denies due to an overlay might be quickly approved by another who gives more weight to your low DTI or large down payment.

Conclusion: Your Full Financial Story Matters

As we've seen, your steady income and low debt can tell a more compelling story than a FICO score from two years ago. A past hardship, when properly explained, can be seen as a sign of resilience, not a permanent disqualification. A credit score is just one chapter, not the entire book.

Underwriters are trained to read deeper, evaluating patterns of responsibility, your ability to manage debt, and your stability over time. By focusing on building a strong overall profile—managing debt, maintaining stable income, and saving for the future—you tell a story of reliability that numbers alone cannot.

"Credit scores are only one part of the story. Mortgage decisions are made by understanding the full financial picture."

Now that you know your whole financial story is what counts, what's one step you can take to tell it more clearly?

Agent | License ID: SL3584145

+1(240) 695-2907 | callseansherrie@gmail.com